Belgium

Consumer loans insured by one of the largest reinsurers in the world

Belgium, with Brussels as its capital, is a fascinating country known for its culinary delights such as fries and chocolate. With a population of around 11.7 million people, the country offers a diverse culture and a rich history.

The Belgian economy is impressive and this is reflected in a GDP of around 57,055 US dollars per capita. The country enjoys a solid AA credit rating from S&P, indicating its financial stability and reliability. Belgium also performs well in the ESG rating, with an A rating that reflects its efforts in terms of sustainability and environmental responsibility.

Belgians (Eurozone) benefit from an average net monthly income of 2,750 euros (2.2k euros), which is indicative of the generally high wage levels and prosperity in the country. Debt per capita in Belgium is USD 33,035 (EUR 29k), which is moderate compared to other countries and can be attributed to the strong economic structure.

As the country's political leader, Alexander De Croo currently serves as head of government and contributes to stable political leadership.

Belgium is not only known for its economic strength, but also for its impressive architecture, historical sites and cultural diversity. The country is a melting pot of cultures and has many fascinating sights to offer.

The P2P platform from Belgium

- Founded in 2015

- Option to purchase insured loans

- Option to sell bonds on the secondary market

- Acts as a lender on its own platform

Dealing with late payments

The handling of late payments varies depending on the platform. Some platforms only use in-house solutions and others use external service providers. Below is an example of Mozzeno's in-house receivables management with the following process structure:

Should the direct debit procedure with SEPA Direct Debit fail:

- Soft collection process in the first 2 months after default

- Final written request for payment with a time window of 30 days

- Declaration as default and registration in the register of the National Bank of Belgium

Transfer of the collection procedure to the Debt Collection Agent (DCA)

Portfolio in Belgium

6,5%

interest rates for newly issued loans (static across all risk classes)

5.510€

average loan amount

1,65

years average remaining term

>0,1%

average failure rate

4,3%

annualized yield

56%

insured loans

>44%

uninsured loans

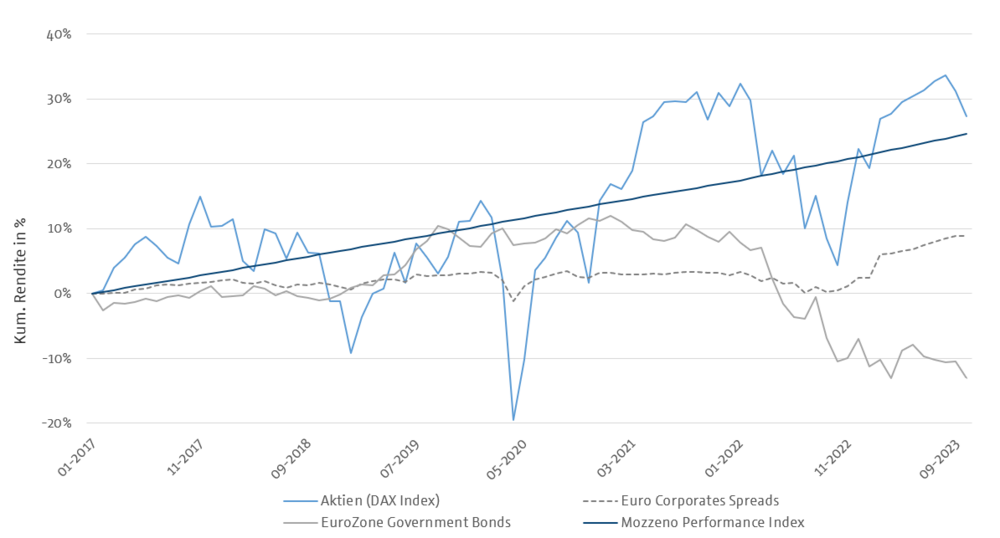

Consumer loans: uncorrelated and profitable

Regulation in Belgium

As an authorized provider of consumer credit, mozzeno is subject to both FSMA supervision (licensing requirements) and the Belgian consumer protection authority. The activities of consumer credit providers are strictly regulated under Belgian law. For example, mozzeno must carry out a strict credit check for every borrower who applies for a consumer loan on its platform, based on the applicant's family and financial situation (income, expenses, dependants, etc.). As part of this check, mozzeno is obliged to consult the National Bank of Belgium's personal credit file, which contains information on existing loans registered in the borrower's name and information on defaults on these loans. If a payment default of more than €1,000 is registered in the name of the Borrower, mozzeno is obliged to refuse to grant the loan.

In order to ensure the proper fulfillment of the obligations arising from the loan agreement, each borrower must irrevocably assign the transferable part of their salary, commissions, replacement income or compensation to mozzeno. This assignment of salary is mandatory in order to obtain a loan via the mozzeno platform. It enables mozzeno - or any person who takes its place - to claim a certain percentage of the debtor's salary in the event of a default leading to the termination of the loan agreement.